1. Introduction – describing the process if SAP HCM in Russia Implementation.

I will describe in this case study the prerequsites and steps in order to implement SAP HCM functionality (OM, PA, TM, PY -modules) on SAP HCM ECC 6.00 applicable for Russian client requirements.

If you are planning to implement or roll-out your HR Global Solution in Russia, I recommend to read this article before project estimation and implementation.

Russian SAP HCM Solution is very complex and requires a deep knowledge of Russian conditions and law peculiarities. In order to understand immediately the depth of solution complexity is enough to open section for the Russian Payroll customizing IMG-> Payroll-> Payroll: Russia:

Image1

I can mark that only one scheme of Russian Payroll driver – RUS0 is about 4810 lines of code. The typical Wage type catalog consists of round 1100 Wage types.

Before implementation you also should know that in Russia it is very strict regulation for document flow: orders , reporting to official authorities should be in paper and some of reporting should be uploaded in .xml format.

In Russian Solution you also should maintain a lot of Official Dictionaries, like OKPDTR, OKSO, Military Catalog, KLADR etc.

2. Prerequisites for RU- Implementation

There are the following mandatory requirements for the system that needs to be done, before the implementation in order to save your time and budget:

2.1. Installed Russian Language

Before the implementation it is obsolete to install the Russian language in the system, because orders and reports should be generated only in Russian language and Information for it should be put on Russian.

Name of Object such as Positions, Job and Organizational units should be kept in Russian in IT 1000 Object and IT 1002 Description and information also is input for personal data in the IT 0002, 0016, 0022, 0290, 0294,0296, 0298

2.2. Check Licenses for Adobe Document Services Credentials , which are required for Adobe interactive forms .

Most standard RU-forms and RU-orders for Russia were realized in .PDF format on base of Adobe Interactive forms, which require licenses for the Adobe Document Services Credentials. If the license is absent, you will not be able to run the forms and orders. These links help you:

https://service.sap.com/sap/support/notes/944221

https://www.sdn.sap.com/irj/sdn/weblogs … xdepth%3D0

Installing Adobe Document Services Credentials:

http://www.sdn.sap.com/irj/scn/go/portal/prtroot/docs/library/uuid/39ce42e6-0401-0010-df96-e28d39742611

http://www.sdn.sap.com/irj/sdn/go/portal/prtroot/docs/library/uuid/70aa75cc-6ac3-2910-c78c-ade192ec861e

2.3. Patch Levels

Before the implementation you need also to install the latest Service Packs(SP), as in the past two years were greatly changes the in Russian Law , e.g. Sick Leave payments and Taxation. If you do not want to affect other countries by installing anew version of SP in your global system, then install the latest SP specially for Russia – Sub component SAP_HRCRU of SAP_HR – SAP_HRCRU. If you already have EHP4, I advise you to upgrade to EHP 5, thus you get a variety of reports on business trips, as well as improve the handling of Absence Quotas, and get improvements for Concurrent employment. In this case also you should check the activation of business function HCM_LOC_CI_01, 02 and HCM_LOC_CI_19.

3. Organizational Management(OM) Issues

3.1. Organizational Management Customizing

Generally the Organizational management customizing is typical as for other countries. Features for Russian Solution are storing long names in the IT 1002 Description in order to output it in the orders and reports and maintaining Objects of working conditions. If you will implement EHP5 , so you can maintain a new Object OR Legal entity for which is maintained IT 1655 legal details which contained legal details for organization.

3.2. Organizational Management Customizing

If we speaking about Long names of positions and organizational units( the full name can be more than 150 Symbols), usually the data for long names of objects is maintained for such Objects of Organizational management like as the Position( S), Job ( C) and Organizational units (O) in the IT 1002 Description Subtype 0001 General Description or make a copy of this subtype ( than put in table T7RURPTCST00 parameter OBJLONGNAMES SUBTY XXXX , where XXXX is the number of customer subtype )

The next requirement for Russia is the maintenance of OKPDTR Dictionary (Russian National Classification of Occupations of Employees, Positions of Civil Servants and Wage Category), which consists of two sections – the profession of workers and office employees. This Dictionary is loaded onto an Object – Job (C). in the IT 1000 Object which has 12-digit code and in IT 1002 Description – full name of the profession. Loading is carried out via LSMW.

Special Russian objects – Objects working conditions are maintained In the Organizational Management :

- Regional condition – CR

- Hazardous condition – CH

- Special – long service condition – CL

- Special – calculated seniority condition –CT

These objects allow to carry out the calculation of seniority for these working conditions and than proceed it in the Payroll and finally get reporting for the Pension fund of the Russian Federation. For these objects are maintained IT 1000 Object on which the code of the working conditions is stored and long name is stored in the IT 1002 Description. Further it will be created relationships in IT1001 Relationships with object Position or Job.

3.3. Reporting (OM):

3.3.1. Staff List (Form T-3)

Form T-3 is official unified form, which is necessary for the formation of staffing list of the company. Organizational units, Positions , Amount of salaries and allowances are introduced in this form.

At the enterprises are also developing Staffing list , which is contained Names of employees, who occupying staff positions or another position and which position are vacant .

The customizing is made to the following path IMG-> Payroll-> Payroll: Russia-> Reporting-> Organizational Management-> Staff List (Form T-3).

3.4. Data Migration of Organizational Management (OM)

Data Migration for OM is provided by means of LSMW, it is requires an additional upload the Russian names of objects in IT 1000 and IT1002 .

3.4.1. Upload the OKPDTR Dictionary

Prepared dictionary is loaded via LSMW object 777 through transaction PP02 for an object Job (C)

3.4.2. Loading working conditions.

The program HRUULSP1 is used to download the working conditions ( IMG-> Payroll-> Payroll: Russia-> Reporting-> Pension Insurance-> Pension Calculation for Special Working Conditions-> Upload Catalogs for Working -there is a help notes for this program).

4. Personnel Administration (PA) Issues

In the Russian part of Personnel Administration is required to provide a serious customizing of info-types and action, as well as the seniority calculation for employee and Personal Orders and Forms.

In the end of Personnel Action , it is creates a SAP HCM RU info type 0298 Personnel Orders (CIS), through which we get Personal orders for the employee (e.g. Order T-1 Hiring , Order T-8 , Termination order as well as employment contracts and supplementary agreements to them).

Info-types is adapted to correctly output the screen parts relating to the Russian data. Screen- 2033 is used for RU-infotypes.

The Russian employer must keep records of employee seniority, the most common types of experience are General seniority, Seniority for insurance, Job seniority and Company seniority (there are also seniority for regional and hazardous working conditions).

The common forms in RU-Personnel Administration are Personal Orders ( t-1, T5, T-6, T8, T-11) and Forms T-2 – Employee Personal card and T-7 – Vacation balance are

4.1. Personnel Administration (PA) Issues Customizing

4.1.1. Customizing of Infotypes:

4.1.1.1. Names on Russian in IT0002 Personal Data

IT 0002 Personal data should be customized to output fields for the employee name in Russian. It should be customized fields P0002-LNAMR, P0002-FNAMR, P0002-NAME2 and check its priority in table V_T522N fo outputting in the reporting .

Also in this infotype is defined Citizenship of employee, which then affects on Payroll calculation.

Image 2 . IT0002 Personal Data

4.1.1.2. IT0006 Address

For this info type 0006 is required to download the K LADR – Russian Classification of Addressees Data. Classification is the official address of the Russian Federation. This dictionary is used to input information to the addresses , which is will be required for the preparation of personalized reports and 2NDFL form . If you enter the address data, it is searched for matches in this dictionary. To upload in the system the KLADR it is used the program HRUUKLADRLOAD. To download the latest version, please visit site of GNIVTS FTS RU (http://www.gnivc.ru/inf_provision/classifiers_reference/kladr/)

The most common addresses are – Home Address, Secondary Address , Birthday place ( required for reporting)

Image 3 . IT0006 Personal Data

4.1.1.3. IT 0016 Contract Elements

This international Info-type has been enhanced , and now, when you create a contract, it is automatically generated number of the contract employee. To customize automatic numbering of Contracts and Supplementation Agreements follow to this patch IMG_>Personnel Management-> Personnel Administration-> Personal Data-> Russian-Specific Settings-> Employment Details-> Automatic Numbering for Contracts.

Also if you put in this infotype in Time limits Probation period it will be automatically created IT0019 Monitoring of Tasks with Term of Probation period

Image 4 . IT0016 Contract Elements

4.1.1.4. Customizing IT0022 Education

In this infotype you should to upload Dictionary OKSO – National Classification of specialties according to education , as well as educational institutions, which are maintained in TableT7RUSCHOOL or you can input it directly in infotypes , If it is activated parameter and value INSERT_SCHOOL – for report MP002200 in table T7RURPTCST00.

Image 5 . IT0022 Education

4.1.1.5. Customizing of IT 0024 Qualifications

In the info-type 0024 Qualifications are stored the data for language proficiency. Group of foreign language qualifications QK define in the transaction OOQA and than create qualification Q for foreign languages. To enabling integration to display Qualification in IT0024 put in table T77S0 –PLOGI QUALI A032 Q Integration switch for qualifications

Image 6. IT 0024 Qualification

4.1.1.6. Customizing subtypes of IT 0290 Documents and Certificates (CIS)

In the info-type 0290 Documents and Certificates (CIS) is stored information about on identification documents, documents for Tax priviledges, etc.

The commonly used subtypes of IT0290 Documents and Certificates (CIS)

03 Birth Certificate

04 Military Officer’s ID Card

06 Minmorflot Passport

07 Military Card

09 Diplomatic Passport of RF Citizen

10 Foreign passport

11 Immigrant Certificate

14 Temporary ID Card of RF Citizen

21 Passport of RF Citizen

22 Travel Passport of RF Citizen

26 Sailor’s Passport

27 Discharged Mil. Officer’s Certificate

28 Driver’s License

801 Tax Payer ID Card

802 Pension Insurance Certificate

803 Notice of Right to Tax Remission (RE)

To customize IT0290 0290 Documents and Certificates (CIS) follow to this patch IMG->Personnel Management->Personnel Administration->Personal Data->Russian-Specific Settings->Documents and Certificates .

In most cases, the subtype 07 Military Card is customized , information for this the military dictionary in this subtype should be input in table V_T7RUM0.

For several subtypes you need to prioritize the their date output for reporting in table V_T7RU0290PRIOR for groups of documents:

- HA-Notice of Right to Tax Remission (Real Estate),

- IC-Identity card for tax accounts,

- IN-INN,

- LC-Passport/ID Card Data for Employment Contract,

- ML – Military card,

- ND-Document confirming non-resident status,

- PC-PFR card,

- PS PFR card (special codes),

- RD-Document confirming resident status,

- TA-Tax accounts

Image 7. IT 00290 Documents and Certificates (CIS) Subtype 07 Military Card

4.1.1.7. Customizing of IT0294 Employment Book (RU)

Under the seniority it is assumed the total duration of employment (work, education ) and other socially useful activities, such as paid and not paid activity . Seniority, as a special measure of the value of work, has a quantitative and qualitative characteristics. Quantitative characteristic of seniority is the duration, the qualitative characteristics reflects the nature and conditions under which the work activity takes place (harmful working conditions, North area , etc.). Influence both on the Sick leave calculation , and on allowances for work in different working conditions.

Basic settings:

For It 0294 Output customizing:

Personnel Management-> Personnel Administration-> Personal Data->Russian-Specific Settings->Employment Details-> Employment Book and Working Conditions->Determine Types of Labor and Other Activities

For Seniority calculation customizing:

IMG->Personnel Management-> Personnel Administration-> Evaluation Basis-> Calculation of Employment Period

1.On the first step is to configure Selection Rule.

1.1 Define Selection Criteria for Infotypes (It’s recommend to take data from the IT 0294)

(Table V_T525A_A and V_T525Z)

1.2. Define Selection Exit:One way to select data in the Selection rule . Contains a functional module that selects data from infotypes for IT 0294 Employment Book (CIS), in this case choose a program RUWB (T525V)

2. Define Selection Class . It is Combines one or more selection rules. (T525NT)

3. Define Valuation Model – Combines one or more Selection Classes

3.1 Sets for each Selection Classes a weighting factor and sets for the Selection Classes limits (V_T525L)

3.2 Define rounding rules (V_T525E)

4.1Define Calculation Process – Object that returns the value of seniority for use in reports, function modules, payroll, etc. (V_T525P)

4.2 Symptom SENOR – assigning the return code for the split in the V_T525S

5. Set records in the workbook in IT0294 Employment Book (CIS) – T7RUSEN

Image 8. IT 0294 Employment Book (CIS)

4.1.1.8. Customizing of IT0298 Personnel Orders (CIS)

Once the user completes the Action, the last step is to output info-type 0298 Personnel Orders (CIS). In this info-type it is automatically assigned a number of orders and contracts, signer person, and it is possible to see the Personal order.

Customizing patch : IMG_>Personnel Management-> Personnel Administration-> Personal Data-> Russian-Specific Settings-> Personnel Orders

To configure the Orders you should first configure the connection between Action and the reasons for action in table T7RURs (in the this table it can be specified Details About Reasons for Personnel Actions, which allows to output a long cause of the action). Table T7rur0 determines the relationship between Action and its reason and the Report’s program output . Currently the most printed form of orders are derived through the Adobe Formular and updates are already being applied only to them.

CGrpg | Cty |

| ActR | DT | Program Name | Form | Form |

33 | RU | 01 | 1 |

| HRUA_ORDER_T1 | HRRU_T1 | ADOBE |

33 | RU | 01 | 1 | G | HRUA_ORDER_T1A | HRRU_T1 | ADOBE |

Table 1. T7RUR0 Typical customizing for T-1 Hiring order .

In the feature 33298 is customized input mask for Action orders. Throughout the transaction SNRO It is defined number ranges of orders for Object HRYP298 for Company codes.

Image 9. IT 0298 Personnel orders

4.1.2. Customizing of RU- Action

The main feature is that the information group has at the end of the Action a line in order to create and display the Info-type 0298 for example, where the operation DIS allows you to immediately view during the Action process see the its personnel Order

Image 9. Creation and display IT 0298 Personnel Orders (CIS) in table T588D

Often there is a problem when it is customized Rehiring action on the same day after the employee was dismissal – the main problem is that it is checked indicators in the table T529A more details in the Note 923678 – HR-RU Rehiring or Reentry into company (on the next day too)

The most common of Dynamic action (Table T588Z) are created typically when hiring and firing employees:

When you firing:

- Creation Print orders and Contracts

- Creation IT 0416 Time Quota Compensation , when during the Termination action ,it is limited IT 2006 Absence Quotas.

4.1.3. Customizing of Reports (PA):

When it is customized Orders and Forms, it is necessary to input all Data for Legal entities in the table T7RU9a.

4.1.4. Customizing of Orders (T-1, T-5, T-6, T-8, T-11)

Russian Personal orders are both Individual (eg, the T-1 Hiring order – program HRUA_ORDER_T1) and Group Orders (e.g. T-1A -Group order for hiring -the program HRUA_ORDER_T1A).

If you implemented EHP5, then you can get Forms For Business trips ( T-9, T-10) from the system.

4.1.5. T-2 (Personal Card)

The Form T-2 is a statistical form ,that contains detailed information about each employee in a company. According to Russian legislation, companies must prepare form T-2 for each employee, and keep the form up-to-date. For example, when an employee has personal or organizational data changes, it should be prepared a new version of the form.

4.1.6. T-7 (Vacation Schedule)

Form T-7 is required by State Committee for Statistics (Goskomstat) to prepare for every company in Russia. The form contains details about periods of planed vacation that your employees take each year. Goskomstat requires Legal entity to prepare this form at the start of each year, and again whenever your employees change their vacation plans.

4.2 Data Migration (PA)

The data is loaded by the tool LSMW through the transaction PA40 and PA30. Provided and downloaded to the data for all active employees. The files for Personnel Administration Migration is the following

- Hiring employees

- Hiring Contractors. Employees who are in the company did not have a specific staff position is recorded on the Position with code 99999999

- Employees Termination

- Home Address,

- Birthday place

- IT 0009 Bank Details Migration

- IT 0021-Family Member/Dependents Migration;

- IT 0022 Education Migration

- IT 0024 Qualifications

- IT 0290 Documents and Certificates (CIS):

- Passport of RF Citizen

- Foreign passport

- Travel Passport of RF Citizen

- Pension Insurance Certificate

- Tax Payer ID Card

- Military Card

5. Time management ( TM) Issues Customizing.

The Time management Customizing for Russia is in most cases the same as for other Countries. The first step during Time management customizing in Russia should be Factory calendar’s configuration. Each year, the Russian government passes a new Factory calendar for next year, which governs transfers of holidays. Factory Calendar – a calendar which taking into account holidays and weekends, based on which are created the working schedules, determined number of working hours per month and proceeded Payroll. It shows the true and accurate information about which days re weekends, holidays or reduced working days in accordance of the Government of the Russian Federation resolution.

In one case, if it was implemented Note 1020749 ,it should be customized Special rules for transfer of public holidays in Factory Calendar – RU through the transaction SCAL.

Image 10. Special rules for RU-Factory Calendar.

In another case, it can be generated work schedules for the next year and then to do manually the work day transfer for each work schedule through the transaction PT02

5.1.1. Peculiarities of Absences and Attendances Customizing

In Russian SAP HCM Solution there are a lot of Absences types. Absences can be divided into those that can use Absence Quota and another one that doesn’t use Absence Quota.

Traditionally, creating the Absence Quota for Annual leave, it can be created for Additional types of absences that consume Absence Quota for the Unregulated work or Seniority or for Work in regions of the Far North.

Also, extensive list of absentees for the Sick Leave and Maternity Leaves purposes:

- Sick leave

- Sick leave for taking care of a child under the age of 7

- Sick leave for taking care of a child aged from 7 to 15

- Home accident

- Sick leave for taking care of a family member

- Industrial injury

- Sick leave for taking care of a disabled child under the age of 3

- Sick leave for taking care of a child under the age of 7 in a hospital

- Maternity Leave

- Child Care leave 1,5 years

- Child Care Leave 3 years

Also for the Form T-7 Vacation Balance it should be created a Planned absence through which to create on next year planned Vacation (This Absence is not proceed in Time Evaluation, because it created with blocked status and displays only in Form T-7)

In Attendances also is maintained Work on weekends and holidays, business trips, overtimes etc.

5.1.2. Peculiarities of Absence and Attendance quota customizing

A very important point in Russia’s SAP HCM Solution is Absence Quota generation. Let’s to consider it on the example of Annual leave. If a person worked 15 days and above, he is entitled to 2.33 of Absence quota in work month and if he works all year, so in the end of the year he already has 28 days.

In this situation the problem arises when people will be dismissed or want to know the number of Absence Quota days on date. It is calculated Absence quota , depending on the period of cummulation. Imagine that it is calculated on daily base, then the number of limits can be anything and still have totally different numbers after the decimal point (t.e.365/12 * Number of days). The result should be rounded. The another problem is that standard SAP Solution doesn’t proceed the Absence quota deduction in order of unpaid leaves Maternity leaves. Because of that on projects it is developed User-exit, which deducts the Absent Quota in accordance with those Absences from Z –table.

The developed program calculates the Absence quota number on the day of Termination (or on any given day) by the formula: (28/366 * (366 – number of days> 14) / 366 * number of days worked). Next step I adjust the rounding rules (table T556D):

Image 11. Rounding Rules for Annual Vacation Absence qouta.

SAP is provided solution in EHP5, where it can be excluded certain absence types from an employee’s absence quota by adding the duration of those absence types to the end of the quota validity period:http://help.sap.com/erp2005_ehp_05/helpdata/en/fd/6bccca90774ea59a7e6a782212ba34/frameset.htm

Next problem is the right control of Overtime work. By law an employee may work out only 120 hours of overtime per year. Control is performed either manually or through Attendance Quota or Time valuation.

5.2. Time Management Reporting Customizing:

Form T-13 – Timesheets is used to account for the time actually spent and (or) unfinished each employee organization to monitor compliance with the regime ( established by the employees working hours), to obtain data on hours worked, the calculation of remuneration and to compile statistical reports on the work. This report is run only after the Time evaluation time.

5.2.1. Form T-13 Customizing

To Customize this form follow by this patch:

IMG-> Payroll-> Payroll: Russia-> Reporting-> Time Management-> Working Time Schedule (Form T-13)

5.3. Time management (TM) Data Migration

For Time Data Migration is used LSMW-tool .

5.3.1. Absences Migration

- IT 2001 – Absences

- IT 2002 – Attendances

5.3.2. Absence quota Migration

- It is migrated remains days for certain periods for IT 2006 Absence Quota

- It is migrated data type for vacation from IT 0041 Date Specifications

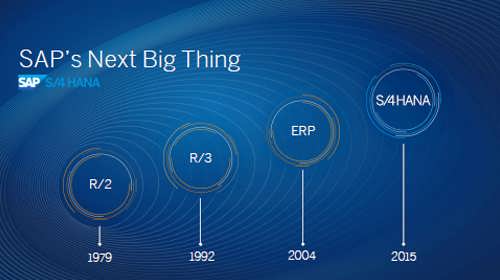

6. Payroll(PY) Issues

Russian Payroll is very complex and difficult in SAP ERP HCM, like in US Payroll , so before its implementation, I strongly advise to find a Russian consultants in order to evaluate realization and real terms of implementation. To understand the depth of the problem look at the scheme RUS0.

6.1. Payroll (PY) Customizing :

For payroll, you should use the standard Payroll driver HRUCALC0 and the modified schema RUS0, if it is installed EHP5, it could be use HRUCALC0_CE and schema RU0C.

6.2. RU PY Infotypes Customizing

6.2.1. It0009 Bank Details

Bank details are designated by employee on infotype 0009. It is required only configuration for this is population of the BNKA table with bank details such as key, bank name, address, etc.

6.2.2. IT0048 Residence Status

The data on the residence status in the country influences on the calculation of income tax: those employees who are not tax residents are charged 30% income tax, whereas tax residents are charged 13% tax rate.

It is described the response of the system to a value in IT 0048 Residence Status in the feature of 33TXS

Image 12. IT 0048 Residence Status

6.2.3. IT0291 Tax and Social Ins. Payments (CIS)

This infotype is used for maintaining information about taxes and net payments.

Image 13. IT 0291 Tax and Social Ins. Payments (CIS)

6.2.4. IT0292 Add. Social Insurance Data (CIS)

Infotype 0292 is used for maintaining information about employee social group. This information is needed for sick payments.

Image 14.IT 0292 Add. Social Insurance Data (RU)

6.2.5. IT0293 Other and Previous Employers (RU)

In this infotype stored information about previous employers payments for current tax year.

Image 15. IT Add. Social Insurance Data (CIS)

6.2.6. IT0296 Garnishment Documents (CIS)

It is using for recording details of the staffs garnishment documents. The system automatically create IT 0295 Garnishment Orders (RU) after completing the infotype 0296 Garnishment Documents (RU) . Used to register the amount of the garnishment document. Impassible to enter the record in the infotype 295 if there is no corresponding record in the infotype 0296.

Image 16.IT0296 Garnishment Documents (CIS)

6.2.7. IT0299 Tax Privileges (CIS)

IT 0299 Tax Privileges (CIS) is used to maintain individual tax exemptions: income tax exemption for a child, tax deduction (Art.218 Cl. 2), tax deduction (Art.218 Cl. 1, 219), material tax deduction etc. It is connected with individual Benefit flag in table T7rut3

Image 17. IT0299 Tax Privileges (CIS)

6.3. WT Catalog Peculiarities

Wage type catalog is a list of charges, deductions and taxes. Russian WT catalog includes round 580 Technical Wage types, round 448 Dialogs Wage types ( wage types with R*** and N*** are used for Regional and North Conditions).

When you create your own WT in RU WT Catalog , take the following into account:

Step | Table | Value | Description |

1 | V_512W_O |

| Wage type(WT) code creation and WT Valid dates |

2 | V_512W_T |

| Short and full name of WT |

3 | V_511_B |

| Define the required personnel area and employee group |

4 | V_T512Z |

| Define Wage type permitted WT for infotypes |

5 | V_512W_O | 10 | Define Class for reducing in proportion to the worked hours |

6 | V_T511 |

| Payment type (deduction/accrual), input type ( amount, percent, constant, automatically) |

7 | V_512W_B |

| Define valuation bases |

8 | V_512W_O | 30 C | Define Class for cumulation period |

9 | V_512W_O | 65 | Valuation according to principle of averages |

10 | V_512W_O | 13, 14 | Include in cumulation for Total gross amount |

11 | V_512W_O | 20, 21, 22, 23, 24, 25, 26 | Include in cumulations for Pension Social Security and Medicine Funds |

12 | V_512W_O | 02, 03 | Define analysis class for output in Pay slip |

13 | T7RUNC |

| Included in Wage type grouping for the reporting |

14 | V_T52EZ |

| Define for postings (Debit/credit) |

Table 2. WT creation for RU-Wage type catalog

6.4. Payments peculiarities

There are also Fixied Salary payments and Hourly wage in Russia. In Russia there are a lot of compensatory payments connected with working conditions. Regional premium is made for work in the regions of Extreme North and equivalent areas. Calculation is made by multiplying regional premium rate by a sum of charges in a calculation month subject to regional premium rate charging.

It is customized in the feature 33BMC For every personnel area is assigned Bonus Model. Bonus Model is maintained in table T7RUB1. It is assigned to Bonus Model wage types and scales in table T7RUB3. The names of bonus scales are maintained in table T7RUB4. The percent of allowances is input in table T7RUB5.

Payments for Harmful conditions are made for hours worked to employees whose positions are connected with insalubrious and hazards working conditions. Usually it is input Payment for harmful working condition in It 0015 or put time in IT 2002 or 2010 and then It is calculated through time evaluation than it will be proceed in rule RU25.

Payments for non-worked hours ( e.g. Vacation, Donor days) with average earnings maintained. Salary calculation is made on the basis of average earnings. The calculation period is considered as 12 calendar months preceding the month of the beginning of the event. Daily earnings are calculated by dividing the sum of earnings for the salary calculation period by the worked days for this period. Average earnings sum is defined as the product of average daily wages by the days of absence.

All types of paid absence refer to the appropriate Absence valuation rule, which connection is configured in view V_554S_G.

Te common evaluated absences are grouped by the Absence evaluation rule . The rule defines evaluation as a paid absence, and then generates a WT for accruals . Absence evaluation rule is maintained in view V_T554C.

The Cumulation rules are configured in view V_T51AV_B in accordance with cumulative types of payments – the basis of average values.

6.5. Tax peculiarities

Personal income tax is collected from all staff that are tax residents of the Russian Federation, as well as from the staff members that get income from the sources of the Russian Federation and are not tax residents of the Russian Federation.

Depending on category of tax payer Income tax can be 13, 30 and 35%

Tax schema controls the payments for income tax. It is customized IMG -> Payroll-> Payroll: Russia-> Tax and Social Insurance Payments-> Maintain Taxes and Social Insurance Payments.

Each Personnel area has Tax schema in table V_T7RUP0. Tax schemas are described in table T7RUP1. Personnel grouping for Tax schema is described in feature 33ТАХ.

Depending on thee return value of feature fro m the table T7RUP3 , it will catch up with some tax class. Tax classes is maintained in table T7RUT1. Here you specify the scale for the deduction of taxes and benefits that must be applied to this tax.

To calculate the tax base tax payers can get standard tax deduction. Standard tax deductions are provided to the tax payer on the basis of his written statement and the documents confirming the right of such tax deductions.

The size of tax deductions is configured in the view V_T7RUT3.

6.6. Sick leave peculiarities

In Russia there is a lot of Sick leaves. Sick leaves are paid partially by Employer and by Social Security found. Generally , Sick leave Payment is calculated on the basis of average earnings. The average daily wage is calculated by dividing the sum of earnings for 2 years at 730.

The function RUSIO proceed the Sick leave. The total amount of average earnings (based on the data received from other employers) for each calendar year does not exceed the limit value base for the calculation of insurance premiums to the FSS RF, established in 2012 (463,000 rubles) , it is defined in table T511P . Amount of daily allowance is calculated by multiplying the average daily wage rate on the insurance seniority.

In table T7RUT5 is stored the amount for Social group (which is defined in table T7RUT6)

In table V_T7RUT5_PAID you can assign the amount of sick leave days and WT which paid by employer.

Amount of payments for sick leaves ,e.g. 1,5 year Child care leave , is configured in table T510J . Wage types SI10, SI11 in IT 0293 stores bases for the calculation of insurance premiums in the FSS. The Wage type SIRT in IT0015 stores averages rate for Sick leaves pavement.

6.7. Deductions peculiarities

Fines and Alimonies are maintained in table T7RUG1. Types of Garnishment orders are maintained in table T7RUG0. It is processed by the function RUAID.

In the case of processing multiple deductions priorities are processed by function RUPRI.

The rules for deductions are adjusted in the table T7RUD3. Priority of processing in case , if it is not possible to deduct the whole sum, is stored in view of V_51P6_B.

6.8. RU Payroll Schema – RUS0

Subschemas | Description |

| The start of payroll processing |

| ENAME – Determine name of Employee from IT 0001 RUSPL- function is used for internal table WPBP splitting in case of : 2)There is a dates in table T51D5 P0014 –WPBP split in accordance with periods from IT 0014 |

| Subschema RUR0 – Import previous result current period RUFUP (Parameter 4 = PTAB) – Import table FUP from OFUP |

| P0014 – Import WTypes from IT 0014 P0015 – Import additional Payments from IT 0015 RU293 – import data from previous Employer from IT ИТ0293 RU267 – Import additional off-cycle payments from IT 0267 Rule RUSC – Prepare percent of allowances For regional and North condition. |

| RURAB – Absences reading according with quotas RUNAB – Refinement of the table AB (a partition shall record the absence on the calculating period) PAB – Absence processing RUGAB – This function determines the duration of periods with a 40- week spread over five or six working days (target time), defined by : – Duration of incomplete periods -Duration of complete periods -Target time for one year -Target time resulting from absences. P2003 – imports the shift substitutions entered in infotype 2003 PARTT (PSP) – Defining the parameters of incomplete periods Rule RU1N – Create valuation bases (addition) DAYPR – Day processing Rule RUF0 – Time calculation for Averages Rule RUF4 – Numbers in calendar days for Vacations Rule RUF3 – Number of public holidays Rule RUMN – Minimal Salary calculation for Sick leaves P2010 X930 –Import employee remuneration information from IT 2010 ZLIT – Total records – to ZL and IT P0416 – Process Quota Compensation RUOAV – Check the data in field SPPE1 in IT2001 for Absence. Subschema XIW0 – Incentive wages Rule RU25 – Valuation of time wage Rule X020 – Gross and RT storage for time wage for calculation class 3 |

Business trips (Subschema RURE) | ASREI – The function ASREI cumulates all the travel expenses for an employee per period in wage types |

| If the employee is not working full time, you must recalculate the sums to obtain the proportionally Rule RU23 – Gross input and storage in RT in accordance with 20 Processing Class. |

| Sub-schema RUAV and RUA0 perform all absence calculation The function RUAVE is proceeded the technical WT / V*, generated by the rules of RU17, RU18, just before calling the function, along with the main type of payment for M *, generated by a function of PAB in the absence proceeding, based on the settings table T554C. Rule RUA3 – Processing Averages after RUAVE Rule RUA4 – Processing Sick List Rule RUA5 – Restricts Baby Care Compensations (Maternity leave for 1,5 year) Function RUFUP processes the results table for calculating to future periods, that is, table FUP. Rule RU62 – Cumulation & storage WT in accordance with 62 Processing class . |

| Subschema RUSC Derived WT ( regional, northern ). Generates WTs for regional and north allowances . Percent value is prepared by the rule RUSC, which is used separately for basic payments , bonuses, vacation payments. |

Loan processing

| P0045 – Function P0045 processes the master data in the Loans infotype (0045) Loans RUC45 – The function redefines all currency fields related to loans to another currency. |

Processing deductions and storage

| Rule RU14 – processing delay of the preceding period Rule RUDE – Process Garnishments in accordance with priorities Rule X024 – Gross input and storage in RT in accordance with Processing Class 41 |

Taxes

| RUTAX proceed information from IT 0001, 0002, 0048, 0291 Rule RUD9 – Gross input and storage in RT in accordance with Processing Class 70 |

| RUA9 RUD1 – proceed WT from the previous periods (from LRT into IT) |

| There are the following features in this subschema : calculation of delta for income taxes, the transfer of deltas from the previous period, the reading function the transfer of alimonies and fines, the formation of the payment amounts, the function reads data from P0009 Employee bank account detail in IT 0009 |

Retroactive accounting

| Used for Payroll recalculation |

Total amounts (Subschema RUE9) Export results in cluster (Subschema RUO2) | Check table IT, refresh table RT ADDCU – Update cumulations according to the processing class (CRT) EXPRT UR – Export Payroll Data in Payroll Cluster UR. |

Table 3. Russian payroll Schema RUS0

6.9. Posting Peculiarities

Most posting configuration can be found at IMG path: Payroll à Payroll: Russia à Reporting for Posting Results to Accounting.

- Table T52EK is where symbolic accounts must be defined.

- Table T52EL maps wage types to symbolic accounts including posting details such as account type and credit/debit designation.

- Table T52EM is where EE grouping codes are defined.

- Feature PPMOD is where employees are assigned to grouping codes based on organizational data.

- Date identifier for posting – V_T549S_B

6.10. Reporting (PY)

PY reporting is the also the difficult theme in Russian Reporting. It is required to customize the output form in .PDF format and download the report in .xml format.

6.10.1. Pay slip

Pay slip is customized as usually in tr. PE51 . It analyses classes for WT , which you defined for output wage type in Pay slip

6.10.2. Form 4 FSS- form is for payment of contributions to the fund of social insurance

6.10.3. Form RSV-1-form is for the calculation of accrued and paid insurance premiums to the Pension Fund of the Russian Federation, the insurance premiums for compulsory health insurance in the Federal Fund for compulsory medical insurance and territorial funds of compulsory medical insurance payers of insurance premiums, making payments and other compensation to individuals.

6.10.4. Form SZV 6-1-2- Information on accrued and paid insurance contributions for compulsory pension insurance of the insured and the insurance period of the insured , 6-2- Registry data on assessed and paid insurance contributions for compulsory pension insurance and the insurance period of the insured

6.10.5. Form 2 NDFL- a form on which employers report for taxes assessed on personal income

6.10.6. Payroll Sheet (Form T-53)- is payroll unified form

6.11. Data Migration (PY)

6.11.1. Data Migration for previous Employer

Create files for IT 0293 for WT /DA0 , SI09, SI10 аnd loaded tax deductions through LSMW.

6.11.2. Data Migration for Payroll Cluster

You must download the data for the year prior periods in order to ensure the correct calculation of pay for the average values ??within a year after the start of a productive system For this purpose, load data into tables T558B and T558D, or use outdated table to load the T558A, which contains fewer fields than the previous table. Loading of the tools used, or LSMW – BUS7023 and IDOC to load the data, but in this case triggered numerous checks and loading is interrupted when transferring 100,000 entries and more. The second option – developing its program for downloading data base can be taken from this. Before the Migration the Personnel Administration data must already be uploaded the staff, and WT should be customized

The order of loading:

1.Check the format and completeness of the data being loaded

2. Erase entries in the tables T558

3 Load the records into a table with the help of a program or LSMW

4. . Clean the cluster of loud personnel numbers with the report – RPUDEL20 or its modification

5 Use a standard report RPUTRBK0 and move the date in IT 0003 “The status of the calculation of” employee number of load

6. Create your chart data is loaded into the cluster with scheme RU30 or RLK0

7. load the required personnel number with created Migration Scheme in Payroll driver HRUCALC0

SAP also proposed a new solution for PY Migration in the note 1677296 – HR-RU: Report HRUURU30 – Uploading old payroll data to SAP

Оставить комментарий

Подпишитесь на рассылку статей.

Не волнуйтесь, мы не spam

0 Комментариев